As a business owner, deciding how to extract profits from your firm could be a crucial decision. It may affect your tax liability and that of your company. Read on to understand three essential ways you could take money from your business and potential tax implications you might want to weigh up before deciding which is the right route for you.

Many business owners will use a combination of the three options below to extract profit from their business to fund their day-to-day expenses and create long-term financial security.

1. Taking a salary

An obvious way to access profit from your business is to pay yourself a salary.

Paying yourself a salary from your business could help ensure you have a regular income to cover day-to-day expenses. A reliable income source could also make some situations more straightforward, such as applying for a mortgage. So, you might want to consider your short- and medium-term plans when deciding your salary.

In addition, you may also factor in how your salary could affect your tax liability. Your salary could be liable for Income Tax in the same way as other employees.

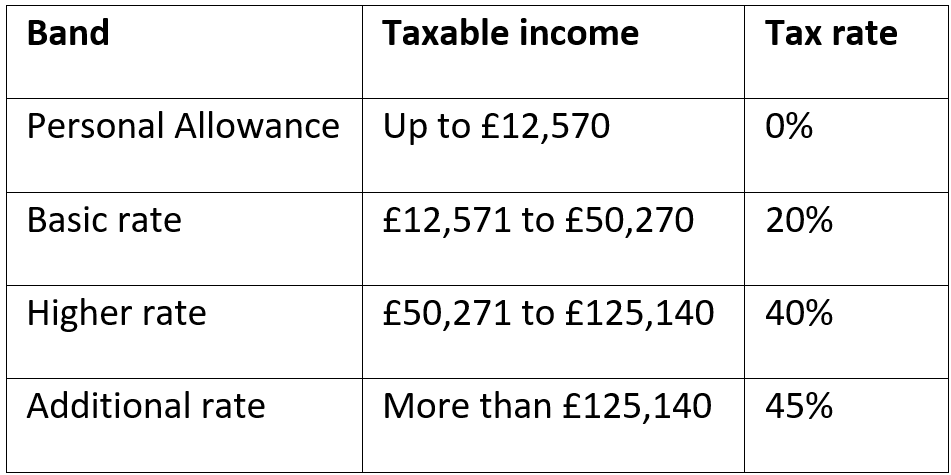

For the 2024/25 tax year, the Income Tax bands and rates are:

Income Tax allowances and rates are different in Scotland

Being mindful of the Income Tax thresholds might help you to manage your finances and avoid an unexpected bill.

As well as Income Tax, there could be other taxes and allowances you factor in. For instance, moving into a higher tax bracket could reduce your Personal Savings Allowance and lead to you paying tax on the interest your savings earn. In addition, high earners could be affected by the Tapered Annual Allowance, which reduces the amount you can tax-efficiently contribute to your pension.

If you would like to talk about the implications of your Income Tax bracket when setting your salary, please contact us.

2. Supplementing your income with dividends

Dividends could be a tax-efficient way to boost your salary. They provide a way to distribute company profits among its shareholders. So, when your business is doing well, dividends could supplement your other sources of income.

In 2024/25, the Dividend Allowance means you can take dividends up to £500 before tax is due. This allowance has fallen in recent years – it was £2,000 in 2022/23. So, if you’re a business owner who uses dividends to extract profits and haven’t reviewed your tax liability recently it could be a worthwhile task.

Dividends could prove valuable even if you exceed the Dividend Allowance due to the tax rate likely being lower than the rate of Income Tax.

The rate of tax you pay will depend on which Income Tax band(s) the dividends that exceed the allowance fall within once your other income is considered. For 2024/25, the Dividend Tax rates are:

- Basic rate: 8.75%

- Higher rate: 33.75%

- Additional rate: 39.35%

It’s not possible to carry forward your Dividend Allowance if you don’t use it in the current tax year. So, making dividends a regular part of your income could be useful.

3. Making pension contributions

Making pension contributions could help secure your long-term finances. This is because a pension is a tax-efficient way to save for your retirement – the investment returns held in a pension aren’t liable for Capital Gains Tax.

In addition, your contributions benefit from tax relief at the highest rate of Income Tax you pay. So, if you’re a basic-rate taxpayer who wants to top-up your pension by £1,000, you’d only need to deposit £800.

Usually, your pension provider will automatically claim tax relief at the basic rate on your behalf. However, if you’re a higher- or additional-rate taxpayer, you’ll need to complete a self-assessment tax return to claim the full amount you’re eligible for.

As well as contributions from your salary, you can set up employer contributions from your business to support your retirement goals.

In 2024/25, the pension Annual Allowance is £60,000. This is the maximum you can pay into your pension while retaining tax relief. However, you can only claim tax relief on 100% of your annual earnings. All contributions count towards your Annual Allowance, including employer contributions and those made by other third parties.

Remember, you can’t usually access your pension until you’re 55 (rising to 57 in 2028). So, if you’re using pension contributions to extract profits from your business you may want to consider when you’ll want to access the money and your long-term plans.

Extracting profits tax-efficiently could reduce your business’s Corporation Tax bill

As well as your personal finances, you may want to incorporate your business’s tax liability when deciding how to extract profits.

Corporation Tax is paid on the profits you make, and some outgoings are allowable expenses that could be deducted during your calculations. Allowable expenses may cover employee salaries, including your own, and pension contributions. In addition, employer pension contributions are deducted before employer National Insurance is calculated.

If your company makes more than £250,000 profit during a tax year, you’ll usually pay the main rate of Corporation Tax, which is 25% in 2024/25. If your company made a profit of £50,000 or less, then you’ll pay the “small profits rate”, which is 19% in 2024/25.

You may be entitled to “marginal relief” if your profits are between £50,000 and £250,000. The relief provides a gradual increase in the Corporation Tax rate between the small profits rate and the main rate.

Keeping these thresholds in mind when you’re extracting profits from your business could help you make decisions that are tax-efficient for both you and your company.

Contact us to talk about your personal finances

As a business owner, your personal finances might be more complex. We could offer support and create a tax-efficient financial plan that reflects your circumstances and long-term goals, including your business exit strategy. Please contact us to arrange a meeting to discuss how we can help you.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.